2. Understanding Coverage Options

3. Frequently Asked Questions (FAQs)

4. Myth vs. reality – common misconceptions

5. Additional Resources and Tools

- Finding an Insurer

- Leading Insurance groups in France

- Average annual cost of home insurance premiums in France

- Useful Websites

1. What is Tenant Insurance?

A. Definition and Scope

This aspect of renting in France might seem daunting, especially when it involves navigating a foreign insurance landscape and grappling with language barriers.

If you hope to rent a furnished or unfurnished apartment in France and wonder whether you’ll need to take out an insurance policy, the answer is absolutely!

If the tenant does not insure the accommodation, the landlord can choose to terminate the lease or take out insurance on behalf of the tenant (and get reimbursed).

Tenant must also provide a copy of their insurance certificate (attestation d’assurance) before moving into the property.

If you are a tenant of a rented accommodation with a residential lease (including a mobility lease), you must take out home insurance. This obligation applies regardless of your nationality and the length of your stay in France.

If anything happens to you or you cause damage to the house you have rented, you are not covered by the homeowner’s insurance. This can range from breaking a coffee table to accidentally burning the house down.

B. Legal Requirements in France

According to French law, you must take out risques locatif insurance if you rent a property. It covers the tenant for any damage to the property. All insurance must include responsibilité civile, also known as third-party liability insurance, which covers you if someone else damages your property.

The minimum insurance required by a tenant is for risques locatifs, but a more prudent policy would be for multi-risques d’habitation, including damage or theft to personal belongings.

You can also add additional insurance from the list below, which may be helpful in certain circumstances.

- Multi-risk insurance (Multirisques habitation)

- Base Guarantee insurance (Garanties de base)

- Optional coverage insurance (Garantie optionnelle)

- Claims by neighbors and third parties (

Recours des voisin et des tiers)

Note: Don’t confuse the security deposit (le dépôt de garantie), which covers utility charges (electricity, telephone, cleaning), or not paying the rent, with insurance, which covers the cost of specific damages.

What does home insurance guarantee?

Home insurance mainly covers the damage to the property and the civil liability of the insured.

Housing and furniture coverage

The multi-risk home insurance covers any damage to the tenant’s rental apartment, including fire, water damage, frozen pipes, natural disasters, storm damage, burglary and vandalism, and glass breakage.

However, a multi-risk home insurance policy typically does not cover cash, stocks and shares, business assets, and vehicles.

Civil liability

This policy compensates you for damage you cause to your neighbors and third parties (for example, water damage or fire originating inside your rental apartment and causing harm to others).

Personal liability coverage

The personal liability policy covers you and the other household members against damage or loss caused to a third party. It covers physical injury, property damage, and intangible consequential loss.

C. Types of Coverage

1. Multi-risk home insurance

Insurance multi-risk housing is a flexible home insurance contract.

It contains the mandatory guarantee of rental risk and optional additional housing-related guarantees.

There are several multi-risk housing formulas, depending on the insurers’ offers and the insured’s needs.

Insurance multi-risk housing may cover in particular the following items:

- Furniture, clothing and household appliances

- Valuables

-

Beautifications for your accommodation (painting, wallpaper, kitchen or bathroom fittings…)

The Multi-risk housing (assurance multi risques habitation) insurance is compulsory for the tenants of an empty rental. It is not obligatory if you’re the owner, but it is hardly recommended. More specifically, the law requires tenants to subscribe to rental risks insurance that covers damage to the building resulting from a fire, explosion, or water damage.

To ensure the contents of your home, most classical French comprehensive insurance policies, multi-risques habitation, include buildings, contents, and civil liability insurance.

Ensure your insurance product also covers your goods or damage caused to neighbors or third parties. If it is not included, you may want to consider purchasing complementary civil liability insurance (assurance responsabilité civile) in your multi-risques habitation.

The multi-risques habitation insurance contract includes several guarantees to ensure the policyholder’s goods (house or furniture) when a tenant is either responsible or victim of damage.

The multi-risques habitation contract mainly covers the following:

- Damage to buildings and, if applicable, their content (furniture) owned by the policyholder;

- If applicable, the civil liability in case the policyholder or the insured individuals unintentionally cause damage to others;

- The civil liability of the policyholder as owner or tenant of the dwelling when he/she is responsible either for damage caused by living there to the tenant or to a third party or damage caused to the goods they rent or to third parties (neighbors, etc.).

-

Depending on the contract, the multi-risques habitation contract can also include a guarantee for legal protection and assistance (home assistance, assistance to persons, psychological assistance, etc.).

Note: To better understand the risks covered by your multi-risques habitation as part of property damage, you should always check the general terms and conditions of the contract.

Usually, the warranties included in the multi-risques habitation contract are the following: fire, explosion, water damage, theft, vandalism, glass breakage, natural disasters, acts of terrorism, or attacks.

So, if you did not subscribe to multi-risques habitation insurance, you are risking the immediate termination of the rental contract.

Besides, you will have to cover the financial consequences of a potential loss, both for your own damage and for that of the third party affected by the event (neighbors, etc.).

The insurer will give you the certificate once the insurance is subscribed.

If you do this online, you can have it same day.

You can get this insurance through your bank often or through an insurer like Maaf or GMF.

2. The basic home risk insurance guarantee

The basic insurance protects your home against the following risks:

- Fire

- Water damage

- Natural disasters (floods, earthquakes, storms…)

- Technological disasters

-

Attacks, riots, and acts of terrorism

3. Optional Warranties

Optional warranties include:

- Theft

- Damage to electrical appliances

- Legal protection (for example, covering legal costs for a neighborhood dispute or a dispute with a plumber)

- Civil liability

-

Assistance at home (in case of personal injury, the insurer offers assistance services such as household help or childcare)

You should check your contract to see if these guarantees are in your basic formula or if they are optional.

4. Claims by neighbors and third parties

The guarantee recourse of neighbors and third parties is almost always offered simultaneously as the rental risk guarantee. But it has to be a separate one. It is often included in the contract for multi-risk housing.

With this warranty, you can be compensated if a disaster occurs in your home and causes injury or damage to your neighbors. Your insurer will reimburse you, but within the limits set out in the contract.

However, this warranty does not cover your property.

5. Garantie villégiature

Many comprehensive home insurance policies in France contain the garantie villégiature, or assurance villegiature, which offers insurance protection to cover different eventualities during your stay in holiday accommodation.

Generally speaking, insurance covers all damage that may be caused by negligence on your part or that of your family or pets in your holiday location.

Some policies also include taking charge of the holidaymaker in the event of theft or destruction of their personal effects in the holiday home.

The owner’s insurance covers eventualities like damage caused by river flooding or faulty wiring but not accidental damage caused by you as a renter.

If you are a French resident, it’s no problem; your home insurance covers you when you rent in France. But if you are not a French resident, you need adequate personal liability insurance to rent a house.

Useful tips:

When you leave your apartment (end of lease), you can cancel the insurance with no penalty. If you paid for a year, they will refund you the money for the unused months.

You need to send them a copy of the “états des lieux de sortie” or inventory list you will do with your landlord when you leave.

In France, it is the law that all contracts and official communications (advertising, conditions, agreements, leases, work contracts, documentation, internal company communications, and everything official) must be written in French to be legally valid. So you will not find a company with those contracts in English.

2. Understanding Coverage Options

Assurance habitation

In France, it is mandatory to have “assurance habitation” or home insurance, which covers any damage that you may cause to your rented place. The cost is generally around 20€ per month and can be quickly obtained.

If you cause damage, the consequences can be grave. You would need to pay for the entire place, and your landlord may also face problems. It is important to note that home insurance is separate from general liability insurance.

Insurance coverage

Rental risk insurance covers damage to the dwelling caused by a fire, explosion, or water damage.

However, this insurance covers only the rental itself. It does not cover damage to neighbors. Another guarantee that must cover these is the recourse of neighbors and third parties, which is optional.

Rental risk insurance also does not cover personal property that could be damaged in a disaster and will not reimburse you. To guarantee your goods, you must subscribe to supplementary insurance, commonly called multi-risk housing.

You must prove to the homeowner that you have taken out rental risk insurance.

To do this, you must provide a certificate of insurance at the following times:

When the owner gives you the keys to the accommodation.

Once a year, at his request.

If you do not provide the landlord with a “rental risk” certificate of insurance, the landlord can choose to terminate the lease or take out “rental risk” insurance on your behalf.

Note: A furnished tenancy tenant is not obligated to take out insurance, but in that case, it is imperative that the landlord has comprehensive cover or insists the tenant take out insurance as part of the letting terms.

Insurance claim

How do you claim insurance for damages to a furnished or unfurnished rental property?

For burglary, file an official complaint with a copy of the police report. For fire, given the potential for significant damage, contact your insurer immediately to discuss the next steps.

Furnished vs. Unfurnished Rentals

Furnished Rental: The tenant’s insurance covers damages caused by the tenant and their possessions. The “Owner Non-Occupant” (PNO) insurer compensates for damages like water damage.

Unfurnished Rental: The tenant’s insurer is responsible for damages caused throughout the lease.

Damage Caused by a Third Party

- Conduct an assessment with the third party.

- Request a copy of the repair bill from the third party.

- Obtain an estimate for repairing the damages.

-

Report the damages to your PNO insurer, including the assessment, bill, and estimate. Insurance companies may conduct a “télé-expertise” based on the cost estimate.

Damage to a Third Party

- Repair the leak to ensure no further leakage.

- Provide the third party with a copy of the repair bill.

-

Declare the damages to your PNO insurer, including the assessment, bill, and, if applicable, the cost estimate.

Excess / Deductible

You will initially receive compensation minus any excess/deductible. This will be reimbursed once insurers resolve the solution, which could take several months.

You must cover the excess/deductible yourself if you’re responsible for the damage.

Expert Assessment

If there is damage, your insurer will commission an expert assessment, which will lead to either acceptance of your cost estimate or a reevaluation. If the cost is lowered, you can request repairs from a partner company at the stated amount.

Property Damages

For example, if a flood damages the property, the building’s collective ownership insurer manages the claim. Three experts will assess and determine responsibility.

Insurance Compensation

After a professional assessment, compensation is typically paid in two installments: an immediate payment (usually 80% of the owed compensation) and a second installment upon completion of repairs and presentation of the bill.

Maintenance and Repairs vs. Damages

The insurer is responsible only for damages, not for identifying or repairing a leak. However, if the search or repair process damages something (e.g., wiring or tiles), the insurer covers the cost of fixing or replacing the affected objects.

When making an insurance claim for rental property damages, be aware of the importance of prompt action, thorough documentation, and clear communication with your insurer.

Examples of securing the proper insurance

Here are some examples of securing the right insurance coverage when renting in France:

1. Imagine you decide to take a bath. However, caught up in time, you forget to turn off the tap, and the bathtub overflows, causing water damage to your bathroom and possibly other areas of your home. In this scenario, you may be eligible for compensation after an expert’s visit to assess the extent of the damage.

2. Unfortunately, you come home one day to find that your home has been burglarized and your personal belongings have been stolen, including your computer, clothes, and other valuable items. In this situation, you may be able to receive compensation up to 5000€ after filing a complaint and presenting the necessary invoices.

3. Picture this: you go for a walk and forget to close and lock your front door properly. As a result, your home is burglarized, and the owner suffers significant losses. In this case, you may be able to receive compensation within the limit of 4000€ after filing a complaint and providing the appropriate invoices.

4. It’s a typical day at home, and you accidentally stumble and tip over your television, causing it to break. In this scenario, you may be eligible for compensation up to 4000€ upon presentation of photos and an invoice for repair or repurchase of the damaged item.

3. Frequently Asked Questions (FAQs)

1. Do I have to insure a furnished rental I am leasing?

If you’re renting a furnished property, the lease requires you to have insurance and present proof of this insurance to the property owner or their agency before moving in. This covers rental liability, as tenants are presumed liable for damages to the rented property in France.

2. Doesn’t my insurance replicate the owner’s?

The property owner’s insurance covers the building and possibly the furniture but not the tenant’s personal belongings or personal liability. So, the insurance you take out doesn’t duplicate the owner’s.

3. The owner says they’ve insured the property for me. Is that adequate?

Policies taken out by owners on behalf of tenants generally cover only rental civil liability, excluding personal effects and personal civil liability. Thus, relying solely on the owner’s insurance is not sufficient.

4. Can my home insurance cover my rental?

Your usual home insurance policy might provide coverage, but if you’re abroad, you must ensure it’s valid under French law to avoid being inadequately covered. French residents might have “villégiature” coverage through their insurance, but it’s often limited.

5. Is civil liability coverage enough?

Merely having civil liability insurance is not enough. This covers incidents between you and third parties under specific codes which do not govern tenant-owner relations. Those are under different legal codes.

6. Is rental liability insurance sufficient?

Insurance that covers only rental liability, known as “rental risks,” is insufficient. It may only cover damage to the building and possibly exclude the owner’s furniture, covering you only if you’re personally liable. It doesn’t cover other incidents like theft or water damage.

7. What is a recommended insurance policy for tenants?

A multi-risk household insurance policy covers damage to the building, the owner’s furniture, neighbors, third parties, personal effects, and civil liability. It typically includes coverage for fire, water damage, theft, vandalism, and natural disasters.

8. Is a deposit still necessary with insurance?

Even with insurance, tenants must still deposit money with the owner. This is because some types of damage might not be covered by insurance (not paying rent, utilities, maintenance), so certain charges remain the tenant’s responsibility.

For more info on questions you might have about renting property in France, check out our Checklist for Tenants Renting in France.

4. Myth vs. reality – common misconceptions

Common misconceptions about tenant insurance in France often include:

1. Some renters mistakenly assume that their landlord’s insurance policy will protect their belongings in case of damage or theft. However, landlord insurance typically only covers the building structure and any fixtures owned by the landlord, not the tenant’s personal property.

2. Another misconception is that tenant insurance is prohibitively expensive. While the cost of insurance can vary depending on factors such as coverage limits and deductible amounts, many affordable options are available, especially when considering the potential financial losses from not having insurance.

3. Some renters may underestimate the importance of understanding their policy’s coverage limits. They might assume that all of their belongings are automatically covered without realizing that there may be limits on certain types of items, such as jewelry, electronics, or collectibles. Tenants must review their policy carefully to ensure adequate coverage for their possessions.

4. Some tenants misunderstand that insurance is optional rather than necessary. While tenant insurance is not legally mandated in France, many landlords require it as a condition of the lease agreement. Even when not mandated, insurance provides financial protection and peace of mind for renters.

5. Some renters may believe that tenant insurance only covers damage to their personal property caused by events like fire or water damage. However, tenant insurance typically includes liability coverage, which can protect renters from legal expenses if someone is injured in their rented property or accidentally damages someone else’s property.

6. Another common misconception is overlooking policy exclusions. Renters may assume that their insurance will cover any damage or loss, only to find out later that their policy does not cover certain events or circumstances. It’s crucial for tenants to be aware of any exclusions and to ask questions if they’re unsure about what is covered.

5. Additional resources

Finding an Insurer

Mutuelles: These non-profit cooperatives hold a significant market share and boast a community-centric ethos. While their altruistic nature may appeal to your sensibilities, bear in mind that their offerings may not be as customizable. Their members include such companies as Macif, Mae, Maaf, MFA, and Matmut.

Banks: Some banks have created subsidiary insurance companies or signed an agreement with an insurer to offer insurance to their clients. Thus, there is Pacifica/Credit Agricole, Banque Populaire/Maif, Société Générale/CGU and Credit Lyonais/Allianz. Generally, their policies are comparable to those of the mutuelles, but they are less flexible in personalizing the contract.

On-line Insurers: These are insurers offering a service exclusively online. These online insurers provide desirable rates, although you will need to read the small print carefully and be aware of their policies and practices regarding claims.

If you can speak some French, then one handy place to start is with an online comparator site.

Two of the largest and most reputable are Empruntis and Assurland.

A newer entrant into the market is the French affiliate of British company Confused.com, called lelynx.fr.

In all cases, you will be asked to complete a questionnaire (proposition d’assurance), which enables the insurance company to evaluate the level of risk and the premium payable.

As you navigate this questionnaire, tread with utmost care, ensuring each response is accurate and comprehensive. A misstep could potentially unravel your entire insurance arrangement, leaving you vulnerable in times of need.

You will need to try to understand the policy’s details, or you risk not fulfilling the qualifying criteria should you need to make a claim.

Leading insurance groups in France

| Crédit Agricole Assurances |

| CNP |

| Axa France Assurance |

| Crédit Mutuel |

| BNP Paribas Cardif |

| BCPE |

| Société Générale Insurance |

| Generali |

| Aema |

| Allianz |

| Groupana-Gan |

| Swiss Life |

| AG2R La Mondiale |

| Covéa (GMF-MAAF-MMA) |

| Malakoff Humanis |

| MASCF |

| HSBC Assurances |

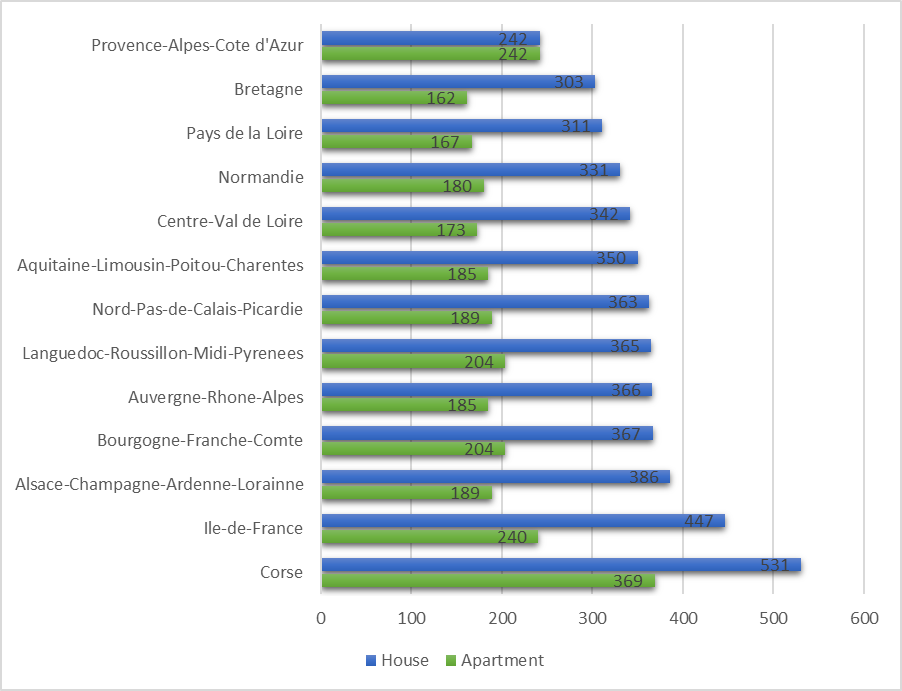

Average annual cost of home insurance premiums in France in 2023 in euros